Your Local HVAC Experts for 50+ Years

50 Years of Keeping the Treasure Coast Comfortable

Contact Us

Schedule Service

We will get back to you as soon as possible.

Please try again later.

Explore Our Full Range of Services

AC Repairs

Stay calm even during the hottest Florida days with fast, reliable AC repair services that restore your system’s efficiency. Whether it’s a refrigerant leak, a malfunctioning thermostat, or uneven cooling, our skilled technicians will diagnose and fix the problem quickly.

AC Installation

Upgrade to an energy-efficient air conditioning system for improved comfort and lower energy bills. Our team helps you pick out the perfect unit for your space, ensuring optimal performance and long-term savings. With modern systems that provide quieter operation and enhanced cooling, you’ll enjoy consistent comfort throughout your home or business.

HVAC Maintenance

Regular maintenance is the key to keeping your HVAC system running efficiently, avoiding unexpected breakdowns, and making it last longer. Our thorough maintenance service covers everything from changing filters to cleaning components and checking performance to keep your system operating at its best.

New Construction

Collaborating with builders and contractors, we provide customized HVAC designs for new homes and commercial properties. From energy-efficient systems to modern smart home integrations, our team delivers solutions that meet your project’s specific needs. Start your construction project with an HVAC system built for comfort, efficiency, and longevity.

Commercial HVAC

We design and maintain HVAC systems for offices, retail spaces, and industrial facilities, ensuring comfort and efficiency for your business. Our HVAC solutions address the unique demands of each industry, from multi-zone systems for offices to robust cooling for industrial equipment.

Indoor Air Quality

Breathe easier with solutions like HEPA filtration, dehumidifiers, and air purification systems that combat allergens and pollutants. High humidity and coastal air can lead to biological growth, biological growth, and respiratory irritants, but our advanced systems help create a healthier indoor environment.

Heating Repair

Florida winters may be mild, but a reliable heating system is still essential when temperatures drop. Our heating repair services address common issues like thermostat malfunctions, blower motor problems, and ignition failures.

Heating Installation

We install advanced heating systems tailored to your property’s needs, from furnaces to heat pumps. Our team evaluates your space and energy requirements to recommend the best solution for consistent warmth and cost-effectiveness.

HVAC Company in Fort Pierce, FL

Port St. Lucie is nestled along Florida’s Treasure Coast and is a vibrant community known for its historic charm, beautiful beaches, and coastal humidity.

These unique aspects make it essential for homeowners and businesses to have reliable HVAC systems.

NisAir Air Conditioning has been the trusted HVAC company in Fort Pierce, FL, for over 50 years. Since 1973, we’ve built a legacy of delivering dependable comfort solutions tailored to the needs of Treasure Coast residents.

As a family-owned business, our mission is rooted in quality service, transparent communication, and a commitment to the communities we serve. With certified expertise and a dependable reputation, we’re proud to be a household name for HVAC services in Fort Pierce, FL, and across Martin and St. Lucie counties. From tackling humidity-driven air quality issues to providing emergency repairs, NisAir Air Conditioning is here to help you maintain a comfortable, healthy indoor environment.

Your Trusted Partner for Comfort

Energy-Efficient Solutions for Humid Climates

Fort Pierce's coastal humidity can lead to indoor air quality challenges like biological growth and biological growth. NisAir Air Conditioning offers specialized solutions, including dehumidifiers, heat pumps, and advanced filtration systems, to keep your home or business comfortable year-round.

Licensed & Certified

Professionalism and expertise are at the core of what we do. Our team holds industry-leading certifications and affiliations, including, TRACCA, FACCA Service Round Table, Treasure Coast Builder’s Association, and many more.

Tailored Solutions for Every Need

Whether upgrading to a smart thermostat, tackling a commercial HVAC project, or improving air quality, we provide customized solutions backed by over 50 years of expertise.

Dependable and Customer-Focused

With over 300 5-star reviews, flexible financing options, and 24/7 emergency services, NisAir Air Conditioning is the trusted HVAC company in Fort Pierce, FL, for reliable comfort and exceptional service.

FINANCE TODAY WITH

We have partnered with GoodLeap to offer flexible payment options for your project. GoodLeap uses a soft credit check until funding and the highest score from all 3 bureaus to see if you qualify. It also takes just a few minutes to get started.

Learn More About Financing Options

Stay Comfortable Year-Round

Ready to experience top-tier comfort and reliability? Let’s make your property the perfect escape from Florida’s heat and humidity.

Have Questions?

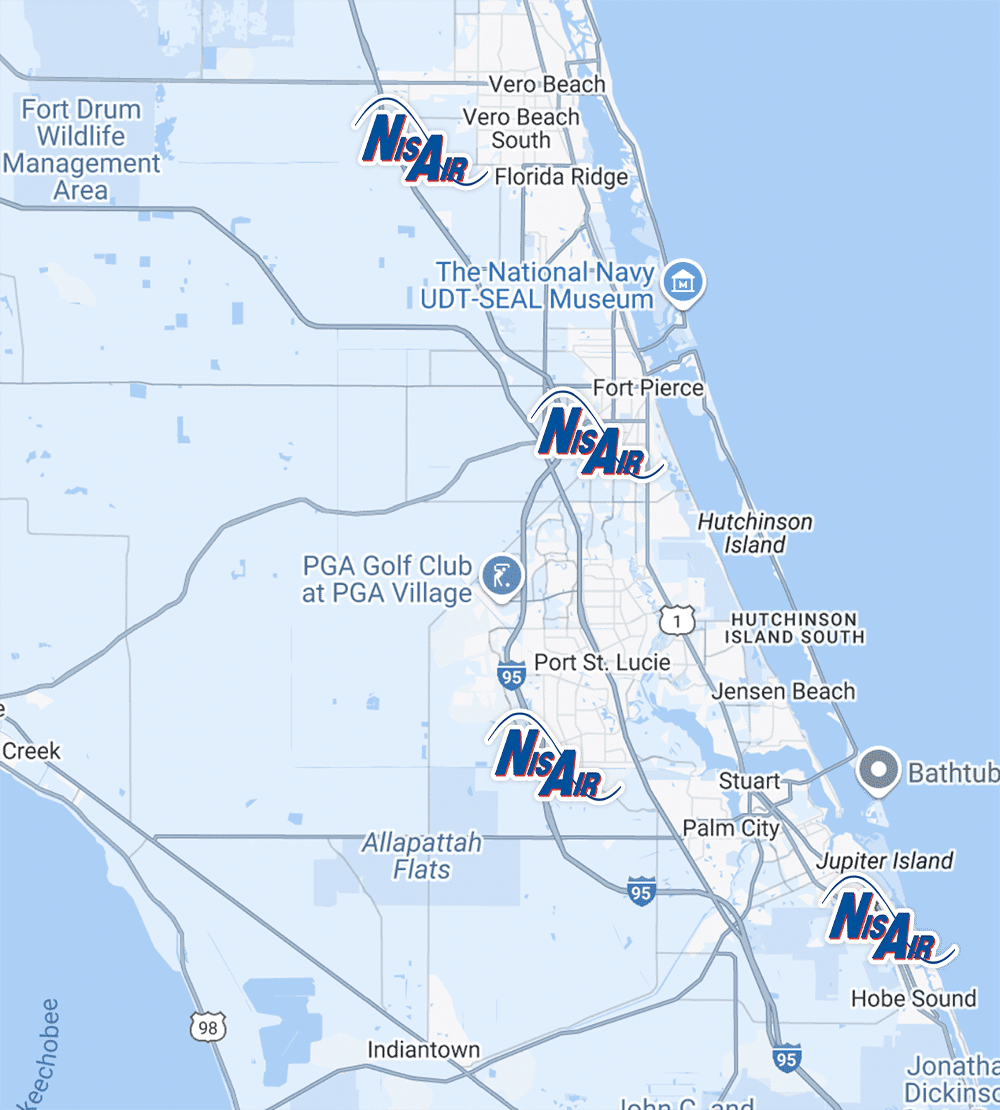

Our Service Area

NisAir Air Conditioning proudly serves Fort Pierce and the surrounding areas with top-quality HVAC solutions. No matter where you are on the Treasure Coast, our team is ready to bring comfort to your home or business.

Wherever you are in the region, you can depend on NisAir Air Conditioning for reliable and affordable HVAC services tailored to your needs.

We serve the following cities:

Fort Pierce

Port St. Lucie

Stuart

Vero Beach

Florida Ridge

Indian River Shores

Lakewood Park

Jupiter

Palm Beach Gardens

West Palm Beach

Don’t see your location? Call (772) 356-4749 to confirm.

And Many More!

What Google Reviews Say About Us

★★★★★

Justin and Jimmy arrived this morning right on time. They gave me very accurate estimates of the time they would need to get everything done. I also had a crane in to put in the roof unit. They were polite, cleaned after themselves, got everything done when they said I would and my very WARM house is now firing on all cylinders. I would recommend NisAir time and time again.

-Kathryn Sullivan

★★★★★

Abu, Cue and Orlando came out early this morning to replace our Air Conditioning System. They lay down tarps to keep the carpet clean and finished two hours before the time they promised to be done by. I would highly recommend this team of installers.

-Robert Guernsey

★★★★★

James and Benny were 100% professional, courteous, friendly and knowledgeable. It is always a pleasure working with NISAIR! Best A/C company hands down! No matter what service you need. The entire experience is always a pleasure.

-Michelle D

★★★★★

Today, Lauryn was our service technician and she performed preventative maintenance on our 2 units. She is very professional, efficient & always has a smile to offer. I will definitely ask for Lauryn for future service calls.

-Gary Shaver

★★★★★

Lauren was friendly and courteous, and so helpful with my regular maintenance. She was very thorough and addressed all my questions. Highly recommend Lauren and NisAir overall for their AC services.

-Jenna Lehtola

★★★★★

Justin and Jimmy arrived this morning right on time. They gave me very accurate estimates of the time they would need to get everything done. I also had a crane in to put in the roof unit. They were polite, cleaned after themselves, got everything done when they said I would and my very WARM house is now firing on all cylinders. I would recommend NisAir time and time again.

-Kathryn Sullivan